• Unlock your edge with a PFF+ subscription: Get full access to all our in-season fantasy tools, including weekly rankings, WR/CB matchup charts, weekly projections, the Start-Sit Optimizer and more. Sign up now!

Estimated reading time: 7 minutes

Fantasy and DFS enthusiasts, bettors and analysts often rely on a wide array of statistics and models to gain a competitive edge. These range from basic box score stats to advanced metrics available in PFF's Premium Stats 2.0 and models like Josh Hermsmeyer‘s Buy Low model and WOPR (Weighted Opportunity Rating).

There is always room for new insights and analyses to help bettors and fantasy managers refine their strategies. That’s why I have developed a new metric that offers several advantages over WOPR. Click here for an in-depth explanation of the model, my process and its advantages.

Week 14 Recap

- WR12 Rome Odunze: 20.2 PPR Points — did better than his average

- WR12 Darnell Mooney: 20.2 — did better than his average

- WR18 Garrett Wilson: 18.4 — did better than his average

- WR22 Quentin Johnston: 15.8 — did better than his average

- WR25 Christian Watson: 15.4 — did better than his average

- WR26 Joshua Palmer: 13.8 — did better than his average

- WR32 Malik Nabers: 12.9

- WR37 Sterling Shepard: 10.3 — did better than his average

- WR41 D.K. Metcalf: 8.9

- WR54 Deebo Samuel: 5.5

The model had a strong bounce-back performance in Week 14 after a slight dip in Week 13. It correctly identified six top-26 wide receivers out of 10 players evaluated. In total, 60% of the model’s selections finished at or better than WR26.

BREAKOUT CANDIDATES: WEEK 15

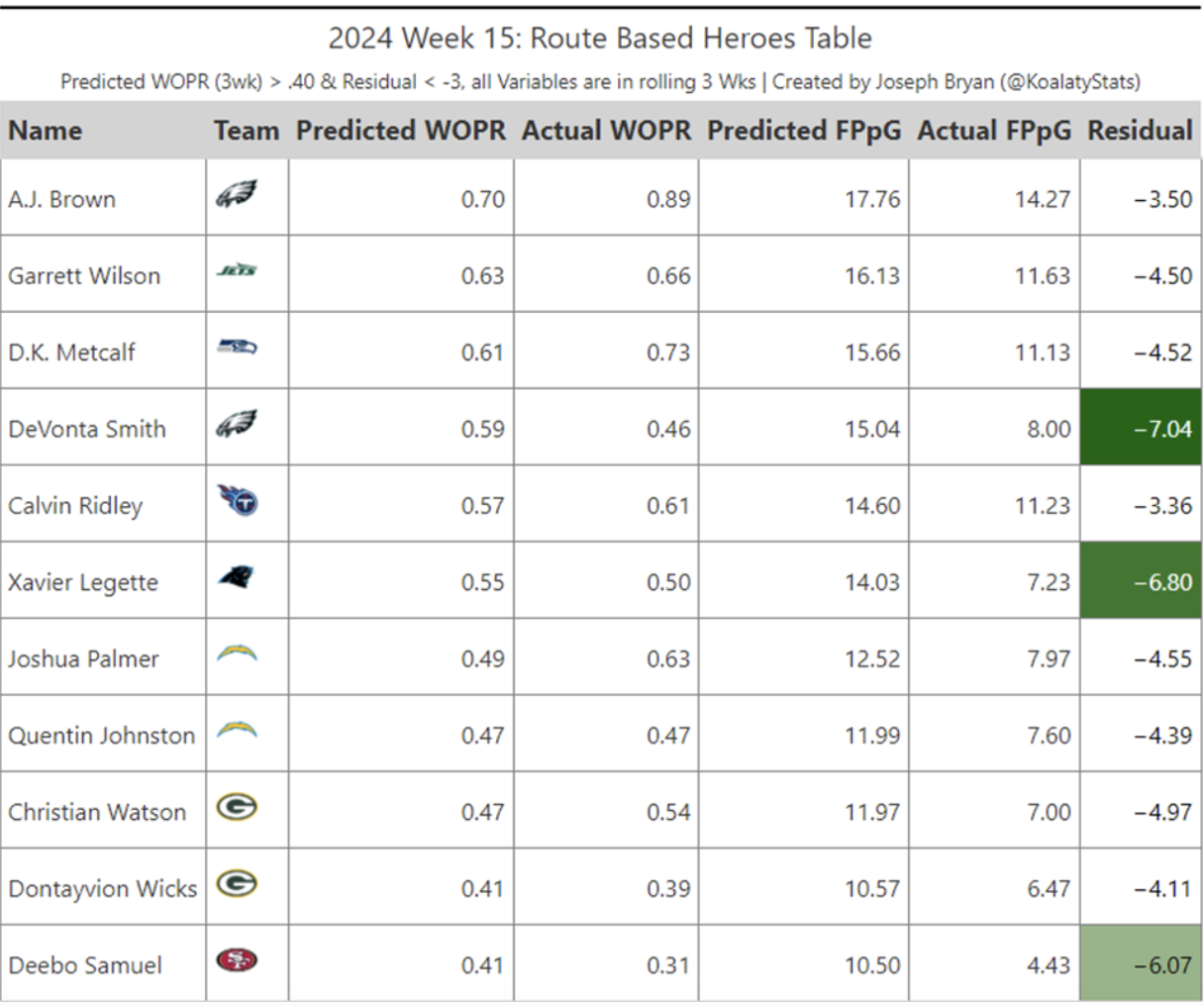

As a quick reminder of how regression-to-the-mean models work, I predict a player’s FPpG based on their three-week PWOPR (explained more here).

PWOPR is much more stable than FPpG and is a stronger indicator of future performance. To identify potential breakout candidates, I calculate the residual by subtracting the player’s predicted FPpG from their actual FPpG. Players with a good PWOPR and a residual of -3 or lower appear on this list. Players will continue to appear until one of the following occurs:

- They fulfill their PWOPR potential with a big game

- Their PWOPR decreases to match their expected FPpG

A.J. Brown: Brown inspired the underlying play-by-play model that drives the Route-Based Heroes game model, and he faces an intriguing matchup against the Steelers. Since Week 9, Pittsburgh has the third-worst coverage unit in the NFL while deploying the highest middle-of-the-field-closed (MOFC) rate. However, the Steelers also rank first in PFF’s team pass-rush grade and sixth in quick pressure rate. If Jalen Hurts and the Eagles’ offensive line can handle the pressure, this could be a breakout game for Brown.

Garrett Wilson: Wilson delivered a solid performance in Week 14 after appearing on the model, but compared to his PWOPR, there's still room for improvement. He has a great opportunity in Week 15 against the Jaguars. Jacksonville allows one of the highest rates of single coverage in the NFL, ranks 16th in coverage and generates the league’s worst quick pressure rate (10.3%).

D.K. Metcalf: Metcalf had a lackluster Week 14 after appearing in the model, and he could face more difficulties against the Packers in Week 15. Green Bay boasts the NFL's seventh-best team coverage grade and uses middle-of-the-field-open (MOFO) coverage at the 11th-highest rate in the league. The Packers also allow single coverage at the lowest rate in the NFL, which could limit Metcalf's chances for big plays.

DeVonta Smith: Smith has the same matchup as Brown, with double the need for positive regression. This could be a great sign for a general positive passing regression for the Eagles, or maybe a sign that Jalen Hurts is struggling to get the ball to his elite receiving corps.

Calvin Ridley: Ridley has been a favorite of the model in 2024. Last week, he saw 12 targets but only managed a middling performance from his seven receptions. In Week 15, he faces the Bengals, who present a decent matchup with the sixth-worst PFF team coverage grade. However, Cincinnati runs middle-of-the-field-open (MOFO) coverage at the second-highest rate in the league, which often limits production for elite wide receivers.

Xavier Legette: Legette was poised for a big game last week, but a critical drop late in the game likely cost him a touchdown. He appears in the model again this week and faces the Cowboys, who run a mix of middle-of-the-field-open (MOFO) and middle-of-the-field-closed (MOFC) coverages. Dallas has the ninth-worst team coverage grade, according to PFF, but they generate the second-most quick pressure in the NFL. This could pose a challenge for Bryce Young and limit Legette's opportunities.

Josh Palmer/Quentin Johnston: Both Chargers receivers delivered solid performances on Sunday Night Football, but after Justin Herbert missed Palmer on a potential 60-plus-yard touchdown and made a few other misreads, they’re back in the model this week. They face an exciting matchup against the Bucs, who deploy middle-of-the-field-closed (MOFC) coverage at the sixth-highest rate, boast the ninth-best PFF coverage grade and generate the most quick pressure in the NFL.

Christian Watson/Dontayvion Wicks: The young Packers duo faces the Seahawks, who use middle-of-the-field-open (MOFO) coverage at the highest rate in the NFL and have the third-best PFF team coverage grade. Neither factor favors an elite performance, but the Seahawks' tendency to pass frequently could create more opportunities for both offenses in this matchup.

Deebo Samuel: Samuel faces the Rams, a team that ranks middle of the pack in most defensive categories. However, Los Angeles has the third-worst team tackling grade, a weakness Samuel — a YAC specialist — is well-equipped to exploit.

Last week's heroes who were on bye: Zay Flowers, Tank Dell and Noah Brown.

As always, not every player on this list will deliver, but several are well-positioned to exceed their recent average PPR, with a few potentially delivering explosive performances. Thank you for reading!

For more NFL stats and analysis, follow Joseph on Twitter/X.

© 2025 PFF - all rights reserved.

© 2025 PFF - all rights reserved.