Every year, there’s a two-week stretch in mid-March when every NFL fan turns on their Twitter notifications for insiders such as Adam Schefter, Ian Rapoport, Mike Garafolo and Doug Kyed.

A player's name flash on their screen along with the team they chose to play for in the coming years. On top of those factors, these tweets sometimes include contract values, which aim to inform fans about the length and how much the player will make throughout the contract.

Nevertheless, these values that are divulged to the public don’t do a good job of presenting the contract's actual value to the player and team. The NFL is such a unique sport because contracts aren’t fully guaranteed (with a few exceptions of course). Teams also differ in the way they structure their contracts — teams such as the New Orleans Saints and Philadelphia Eagles include void years in more contracts than most of the NFL combined while other teams create contracts using standard language that isn’t as complex.

Because of all the variations in the way teams can draw up their contracts, there haven’t been good ways to evaluate them. Contract valuation metrics — such as average per year (APY), percent guaranteed and three-year cash flow — aren’t great ways to measure contracts because each of those metrics either doesn’t account for enough money or it overvalues how much money a player can make on their contract.

Thus, whenever one of the insiders reports the details of the contract, many take the basic parameters of the deal and overreact to how strong/weak the contract is for their favorite team. Websites such as Over The Cap do a tremendous job breaking down the contracts in real-time, but even then, finding ways to compare contracts is a tough ask.

We (Arjun Menon and Brad Spielberger) wanted to create a metric(s) that fixed this issue. Building off Bryce Johnston (now with the Eagles) and Nicholas Barton's (both formerly of Over The Cap) terrific work on the Expected Contract Value metric, we decided to try to apply the same methodologies to 2022 offseason free agents and players that were extended. Using expected contract value (ECV), we can then create other metrics, such as expected APY, and percent of contract expected to earn.

After building out expected contract value, we believe this can serve as a way to truly compare contracts between players to see whose deal is stronger.

One final note before jumping into the methodology, a big thank you to Over The Cap for supplying the data used for this analysis and keeping their database clean and easy to work with.

The Methodology

To build an Expected Contract Value model, we first gathered all multi-year contracts that were signed from 2013 to 2021 and finished in 2022 and before. Therefore, a player such Joe Schobert, who signed a five-year deal in 2020 before being cut in 2022 was included in the data used to train the model. One-year deals were excluded from the dataset because they don’t show us anything about front office decisions, other than the idea that if a player was cut while playing on a one-year deal, it was probably a bad decision to sign them in the first place. Rookie contracts were also excluded because rookie contract values are already set in stone, so again, there’s no real decision-making process involved.

Before training the model, we had to inflate the total value, APY and contract guarantees used for the model since part of the decision-making process when drawing up contracts is to consider how much of the salary cap the contract will account for in each year of the deal.

Outside of those three factors just listed, here are some other variables used in the model: years of the contract, age at signing, draft round, position, type of contract signed, whether they signed with a new team and prorated bonus in the final two years. Our goal was to use all these factors to predict the actual number of years a player is expected to play on that specific contract. After cleaning and filtering the data, we had roughly 1,300 contracts to work with.

From there, we trained a multinomial model to try and predict the probability that a player plays each year of his contract.

Using these probabilities, we can determine a player’s expected APY. To get this, we first have to get the total expected contract value. We can calculate this by multiplying the model’s probability by the base salary for a player in that given year. This can be called expected base salary.

However, if a player’s base salary in a certain year is fully guaranteed, we don’t perform this calculation. Why? We add in an adjustment variable in the ECV calculation, which is basically all the fully guaranteed money in a contract (prorated bonus, guaranteed base salary at signing). We need to add this adjustment in because fully guaranteed money at signing is made by the player on Day 1 of their contract. If we simply added up all the expected base salaries for each year of the deal, we would be underselling how much a player would be expected to earn.

So at the end of the calculation, to find total expected contract value we add together fully guaranteed money and expected base salaries. However, if a player's base salary is fully guaranteed in any year, we don’t count that toward the total expected contract value, as that guaranteed money is already included in the fully guaranteed section.

To get the expected APY, we divide the total expected contract value by the expected years of the contract. Finally, we can perform the calculation to get the percent of the contract expected to earn by dividing the total expected contract value by the deal's actual total value.

Applying the model to 2022 signings

There are 166 contracts (UFA and extensions) signed in 2022 that we were able to generate the expected contract value, expected APY and percent of contract expected to earn values for. It would be an arduous task to post the result for all 166 players, so instead, we’ll pick three players and generate tables for each metric to highlight how the model works.

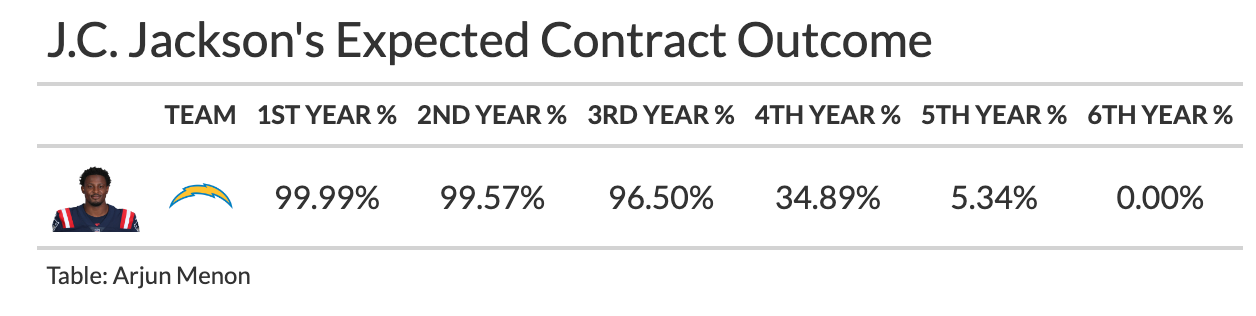

The three players we’ll use are J.C. Jackson (five years), Emmanuel Ogbah (four years) and Chris Godwin (three years).

Step 1: Expected Contract Value

First off, let’s explain the table. The first year equaling 99.99% means there’s a 99.99% chance he plays at least one year of the deal. Based on the outputs, there’s also a 99.57% chance Jackson plays two years of his five-year deal.

Exclusive content for premium subscribers

WANT TO KEEP READING?

Dominate Fantasy Football & Betting with AI-Powered Data & Tools Trusted By All 32 Teams

Already have a subscription? Log in

© 2025 PFF - all rights reserved.

© 2025 PFF - all rights reserved.